Today's dentist has to have more than horse sense...

Your focus should be to work both in your practice, and on your practice.

...Something for Dentists to Chew On

Posted by

Dan Kingsbury, DDS

at

4:16 PM

![]()

Labels: CE-Coaching, Spend-Service/Fncl Planning

It’s no wonder many investors have been lagging the indices badly in this market – as others have noted, the move has been extremely concentrated favoring the largest large-caps over pretty much everything else. So, what's behind the big move and does it make sense to join the party?

It’s no wonder many investors have been lagging the indices badly in this market – as others have noted, the move has been extremely concentrated favoring the largest large-caps over pretty much everything else. So, what's behind the big move and does it make sense to join the party?

From Birinyi Associates Ticker Sense, via the Wall Street Journal:

“The third quarter enjoyed a good, but narrow, advance. The S&P 500 rose 5.7%, but Birinyi analysts point out that half that gain came from 13 stocks, making picking winners critical.”

Source: Wall Street Journal (MarketBeat: 10/12/06)

Our own analysis of the Russell 3000 3rd quarter capitalization sector returns turned up the following:

If you weren’t invested in the top 50 stocks, it’s likely you under-performed the broad market. So don’t feel too bad if you’ve been trailing the market’s advances. You’re not alone.

What’s driving this move? A couple of thoughts:

A slowing economy generally favors large-caps. Any way you slice it, the economy is showing signs of slowing, precipitated by declining housing activity on the consumer side and restrained capital spending on the corporate side.

In the late 1990’s prior to the last two market corrections in1998 and 2000, small-caps peaked ahead of large caps. In 1998 small caps led large caps by three months, in 2000 by more than five. More interestingly, for each capitalization sector, value stocks each peaked ahead of their growth counterparts by between 10 months (mid-caps), and 23 months (small-caps).

So, as the economy begins to slow, market participants rotate out of more speculative small caps into larger offerings believing that these company’s earnings should be more resilient to a slowdown. Additionally, a rotation from value to growth often occurs, as in a slowing economy, investors tend to “bid up” companies with a proven ability to deliver consistent earnings growth.

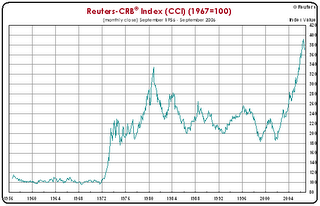

Lower oil and commodity prices coupled with lower bond yields. The argument made is that all else being equal, lower oil and commodity prices, reduce inflation and free up money that would otherwise be spent on necessities for additional consumer discretionary spending. They act like a tax cut – spurring the economy over the short-run.

On the bond side, lower bond yields imply lower expected returns for bondholders in the future, inducing operating companies to undertake more speculative capital projects and investors to risk a larger portion of their capital into the stock market.

For investors, large cap stocks, due to their deep liquidity, often represent the most frictionless way to re-deploy assets efficiently.

That said there is an equally valid argument in the bearish camp which postulates that the rapid deterioration in commodity prices coupled with a prolonged inverted yield curve signal that the economy is in for a noticeable slowdown in the not-too-distant future. Professor Nouriel Roubini of the New York University School of business argues this case extensively in his global economics blog.

Fast capital and the search for returns. In our opinion, one simple reason for the dramatic sell-off in commodities coupled with a “melt-up” in large cap stocks the past few months, though rarely discussed and hard to quantify, is the market impact of hedge funds, proprietary trading desks and other “fast capital”.

It’s no secret that hedge funds have proliferated over the past decade and with estimates of over 8,000 individual funds controlling up to $1.3 trillion in assets, the group has become the marginal buyer and seller for a wide variety of assets. Increasing competition, leverage, and monthly performance reporting all promote a bias towards short-term trading over long-term investing.

Momentum strategies, which key off the assumption of “what has worked in the past should continue to work going forward”, have performed well over the past few years signaling opportunities in small caps, emerging markets and the natural resources sectors that more than a few hedge funds have enjoyed. Furthermore, futures markets for many of the energy, minerals and metals complex commodities have facilitated leverage as well as frictionless entry and exit.

In contast, U.S. large caps have been dormant for the past two years, though analysts have been calling for their rebound for at least the past three! Returns for the largest 200 stocks in the Russell 3000 in 2004 and 2005 were 8.3% and 3.8% respectively - lagging the broader market roughly 3% per year and small caps by 10% annually.

In our opinion, the breakdown in natural resources, emerging markets, and small caps occurring soon after the Fed signaled a pause in their interest rate increases, isn’t co-incidental. It’s the result of a race for the exits from speculative sectors by the fast money crowd, regardless of fundamentals. Still, they have to put that money to work, and what better than the sector of choice in a maturing market.

A point to consider – if the demand for commodities were truly waning, would the commodities under-represented in the futures market, namely the CRB Spot Index, be testing all-time highs?

We're skeptical of the longevity of this large-cap move, believing it to be more technical than fundamentally motivated. Somehow we just can't bring ourselves to delve into stocks such as GM, Verizon and Boeing given their weak stories (in the case of GM and Verizon) or the multiples they command (Boeing). That said, momentum-driven rallies can last for quite awhile, and with the end of the year approaching it wouldn't be suprising to see quite a bit more buying before the fat lady sings.

Posted by

Brian Murphy

at

9:37 PM

![]()

Labels: Invest-Outlook