From our cursory overview of Health Savings Accounts signed into law by President Bush in late 2003 as part of the Medicare bill they seem to have outstanding potential to help families and individuals both lower current health care costs and sock away tax-free funds for future qualified medical expenses. Let’s dig a little deeper and quantify the economic benefits to participants by walking through a real-life comparison.

From our cursory overview of Health Savings Accounts signed into law by President Bush in late 2003 as part of the Medicare bill they seem to have outstanding potential to help families and individuals both lower current health care costs and sock away tax-free funds for future qualified medical expenses. Let’s dig a little deeper and quantify the economic benefits to participants by walking through a real-life comparison.

As noted in our first post on this topic, the Health Savings Account (HSA) program works in conjunction with high-deductible insurance plans. Instead of purchasing traditional, low-deductible insurance participants purchase qualified high-deductible insurance (at least $1,100 deductible for individuals, $2,200 for families in 2007) while setting up a tax-deferred Health Savings Account with a financial intermediary. The high-deductible insurance offers the Health Savings Plan participant savings in the form of lower annual premiums while the Health Savings Account affords a tax-advantaged means of saving for medical expenses.

HSAs can be funded up to the lesser of the insurance plan deductible or a government imposed maximum - $2,700 in 2006 and $2,850 in 2007 for individuals, $5,450 in 2006 and $5,650 in 2007 for families. As medical expenses are incurred, the participant may elect to pay for them using HSA funds. Any HSA contributions made by the participant, whether used during the year or left to accumulate, can be deducted from gross income come tax time.

High deductible insurance has historically been viewed with the stigma of lower quality coverage perhaps owing to the demographic it was originally intended to serve – those otherwise un-insurable. Yet with the advent of HSAs, the plans have been re-worked to appeal to a broader audience, with coverage typically similar to traditional health insurance offerings. Check out your insurance provider’s offerings and we think you’ll see what we mean.

Nonetheless, in order to conduct a relevant economic comparison between traditional and HSA insurance options, it’s crucial to ensure that each plan’s benefits are identical, or at least very similar. For our analysis we chose offerings from Blue Shield of California, specifically the “Shield Spectrum PPO Plan 1500” (traditional insurance) and the “Shield Spectrum PPO Savings Plan 2400” (HSA qualified). Our selection of Blue Shield of California as an insurance provider and the specific plans chosen are not recommendations, but instead meant to merely serve as an example of how we go about evaluating comparable offerings. There are certainly a vast number of health insurance providers available to you and product offerings that may, or may not, be more suitable.

In order to keep our analysis succinct we consider only coverage for a 40-year old individual in this post. It’s likely, though not confirmed, that evaluating family coverage as well as individuals of different ages will result in similar economic conclusions. If there’s interest, perhaps we’ll formally cover additional comparisons in the future. Let us know your thoughts.

Comparing Coverage

A quick overview of the comparability of the plans: The traditional insurance offers individual purchasers a $1,500 annual deductible and $40 fixed co-payments while the HSA-qualified offering has a $2,400 annual deductible with $35 fixed co-pays. Upon reaching the deductible, subscribers to the traditional plan make 30% co-payments with preferred providers (50% for non-preferred) until their out-of-pocket expenses reach $6,000 per year. Interestingly, individual subscribers to the HSA-qualified offering make identical 30% preferred provider co-payments only until reaching $3,200 of out-of-pocket expenses in a given year.

Readers can find a thorough comparison of the two plans here, but all-in-all we view the plan coverage is very similar.

Comparing Apples with Apples

In comparing the potential benefits of pairing a qualified high-deductible insurance policy with a Health Savings Account relative to traditional health insurance it’s necessary to look at each option on an after-tax and “apples to apples” basis.

In this analysis, there are two different tax effects that need to be considered. First, any HSA contributions provide the participant valuable tax benefits in the year they’re made, but leave funds tied up in an account that can only be accessed for health-related expenses. Alternatively, individuals subscribing to traditional insurance coverage receive no tax break for HSA deposits, yet the money they use to pay for their health expenses is not constrained – it could be used for healthcare, clothing, or even entertainment (perhaps a big-screen TV?).

Clearly the different constraints on the cash used to pay for medical expenses under the two strategies make this an “apples to oranges” comparison. Yet there is a way in which to make them directly comparable – simply assume any remaining funds in the HSA account at year-end are liquidated, paying all taxes and penalties needed to do so. Then, in each case, the individual would maintain comparable insurance throughout the year, and begin and end with un-encumbered cash.

From a practical perspective, the process of liquidating an HSA account at the end of the year is a “worse case” scenario that makes little sense, and we advise against doing so. Yet from a theoretical perspective it does serve the purpose of providing a better economic comparison between the two strategies and allows us to confidently state that “HSA accounts provides at least this much value relative to their traditional counter-parts”.

The second set of tax implications that need to be considered is the affect of itemized deductions on schedule A of the individual’s annual tax returns. If you recall, medical expenses (including insurance premiums, deductibles, co-payments, etc.) in excess of 7.5% of the tax filer’s Adjusted Gross Income are typically eligible for deduction. So, while out-of-pocket costs for the traditional insurance buyer may be higher, the possibility of an economic benefit afforded through itemized deductions is also higher.

However those choosing the HSA strategy are further disadvantaged relative to traditional insurance buyers when it comes to itemized deductions. According to the Internal Revenue Service you cannot deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the tax-free distribution from your HSA. In fact, you cannot include any contribution to the HSA or any distribution from the HSA, including distributions taken for non-medical expenses, in the calculation for claiming the itemized deduction for medical expenses.

So, while those with HSAs gain tax benefits from contributions made to the account, these benefits are partially offset through lower deductions for itemized medical expenses on Schedule A. We take both aspects into account in our analysis.

Onto the Analysis

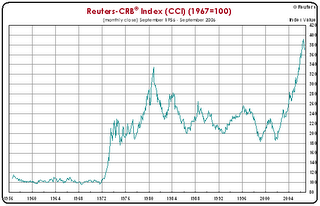

We ran through a range of scenarios for our hypothetical health insurance buyer changing Adjusted Gross Income from $40,000 to $220,000 and the level of medical services purchased from $0 to $15,000 in a given year. The goal is to see whether any clear trends develop with regards to the relative merits of traditional versus HSA plans using out-of-pocket and after-tax, after HSA liquidation costs for comparison.

We present the case of an individual with $40,000 Adjusted Gross Income and Medical Services of $500 in the case below.

Under this scenario the out-of-pocket expenses during the year were similar yet the after-tax, after-HSA liquidation cost of healthcare were markedly lower under the Health Savings plan – primarily due to the lower insurance premiums required.

Putting our results in tabular form, here’s what we find.

Regardless of Adjusted Gross Income and medical services required, the HSA account proved to be the better option economically on an after tax, after liquidation basis. That said, for low service levels the HSA will require the participant to pony up more cash during the year.

Further Thoughts

Want to have your cake, and eat it too? Consider the following ideas offered by the HSA for America (quite a good resource) on their blog:

Put no money in the account, except when you incur a medical expense. This strategy allows you to legally "launder" any money used to pay medical expenses. In other words, by depositing money into your HSA, then immediately withdrawing it to reimburse yourself for medical expenses, you are making your medical expenses all tax-deductible. You may want to use this strategy if you are on a tight budget and want to keep your cash outlay as low as possible.

Fully fund the account, or at least put in as much as possible based on your budget. Take money out of the account any time medical expenses are incurred, and let the rest grow tax-deferred. This strategy will maximize your tax deduction, while making your HSA funds available to pay any non-covered medical expenses before your deductible is met.

Fully fund the account, but pay all medical expenses from a non-HSA account. Reimburse yourself for medical expenses at a later date. This strategy will allow you to maximize your tax deduction, and will also allow you to maximize the tax-deferred growth of your HSA. You can then reimburse yourself, tax-free, at any time in the future for medical expenses incurred over the ensuing years.

Furthermore, the idea of maximizing contributions to your Health Savings Account annually and waiting until the end of each year to determine the source to use in paying for your medical expenses based on your taxable situation may be of even more value. If you decide to pay out of the HSA account, simply write yourself a re-imbursement check. However in cases where you have excess cash on hand and qualify for tax deductions for amounts spent above 7.5% of your AGI it may be advantageous to pay for your medical expenses outside your HSA account.

Market Value

Market Value